Multi-vendor online shops, aka marketplaces, are gold mines when done right. The big dogs are Etsy and eBay, but you can find popular niche multi-vendor sites such as ThemeForest.

The idea behind multi-vendor sites is to allow people, or companies, to create profiles and post their products for sale.

When customers come to your multi-vendor site they can pick one item from John Q web designer and another from Company XYZ and it is all processed through the same shopping cart.

Top 6 Multi Vendor Marketplace Platforms

What is a Multi Vendor Marketplace Platform?

A multi vendor ecommerce marketplace platform is an online system that allows multiple sellers to create their own stores within one larger platform to sell their products or services.

This type of marketplace is similar to a virtual shopping mall, where each store has its own brand presence but is housed under the umbrella of the marketplace.

Key features of multi-vendor ecommerce marketplace platforms:

- Individual Seller Stores: Each vendor can set up their own storefront within the platform, where they can list their products, manage inventory, and customize their shop's appearance.

- Centralized Marketplace: While vendors manage their individual stores, the marketplace owner maintains the overall platform, ensuring that everything runs smoothly, from search functionality to payment processing.

- Shared Shopping Cart: Customers can often add products from multiple vendors to a single shopping cart and check out once, even though they're buying from different sellers.

- Payment Processing: The platform handles all payments, which are then distributed to the vendors according to the terms set by the marketplace.

- Order Management and Fulfillment: Vendors are responsible for managing orders and shipping their products, although some marketplaces may offer fulfillment services.

- Commission Structure: The marketplace owner typically earns a commission on sales made by vendors on the platform.

- Customer Service: The marketplace may provide customer service on behalf of the vendors, although responsibilities can vary.

The multi-vendor payment processing system divides the payments behind the two vendors and everyone goes home happy.

This ecosystem of people creating and selling in one place helps the customer find a more diverse set of products, and you, the site owner can make some big bucks through fees.

Unfortunately, some of the more popular ecommerce platforms such as Shopify and Squarespace are not able to provide multi-vendor interfaces for you.

So, this time we put together the ultimate list of multi-vendor online shops for you to create a wonderful community and potentially make some big bucks. Let’s have a look.

Best Multi Vendor Marketplace Platforms

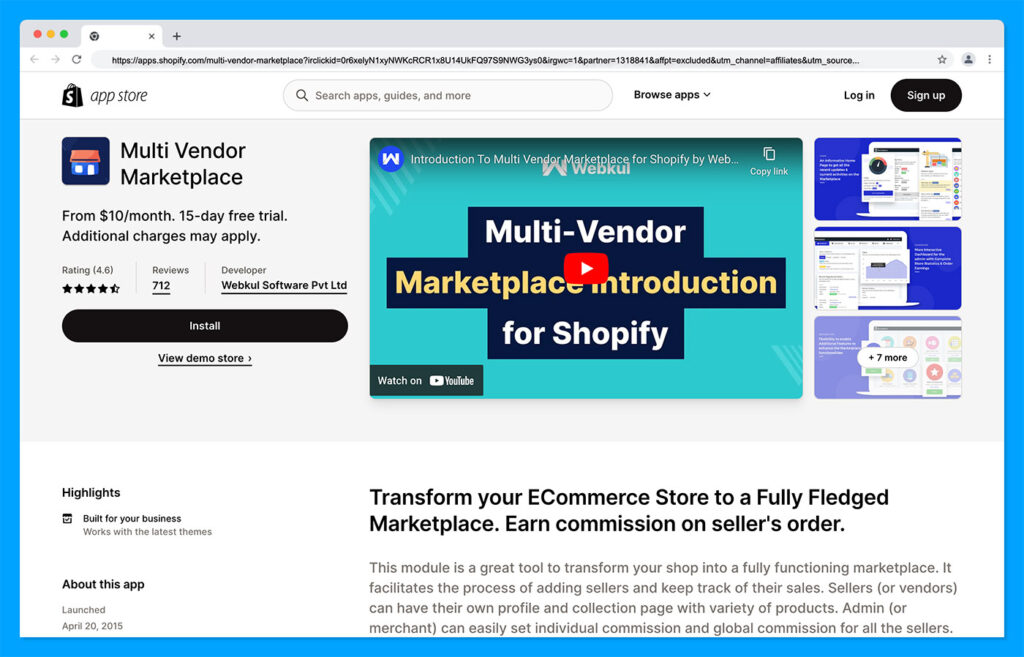

1. Shopify + Multivendor Marketplace

When you download and use the Multivendor Marketplace app, Shopify users can add an unlimited number of sellers to their marketplace.

This gives you the capability to transform your Shopify store into another multivendor marketplace. Who knows?

Perhaps you'll rival the likes of Amazon and eBay someday?

Not to mention, each of your sellers has the opportunity to upload and sell an unlimited number of products to sell to your customers.

You'll also be able to sync your products with stores you have with all the following platforms:

- Shopify Store

- WordPress

- Prestasop Store

- Magento Store

How awesome is that?!

Pricing

On top of your regular Shopify subscription (see our Shopify review here), the Multivendor marketplace app will set you back $10 per month. However, you can get started with a 15-day free trial.

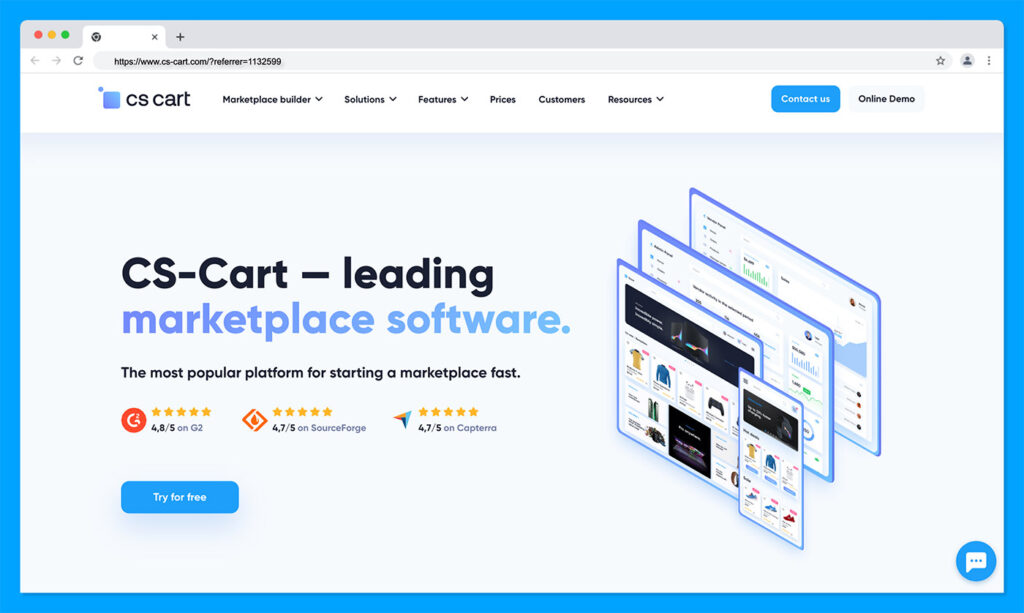

2. CS.Cart Multi-Vendor

CS.Cart is a popular and powerful ecommerce software that allows you to run your site off of your own server, improving security and giving you complete control over your content and maintenance procedures.

The standard packages from CS.Cart doesn't let you make a multi-vendor site, but luckily the company provides a completely separate package for making this happen.

This is wonderful news since you don’t have to integrate a separate plugin – it’s all packaged into one nice platform.

It’s a little more costly compared to the Magento add-on, but it tends to even out when you start thinking about the Magento licensing fees.

Overall, the CS.Cart Multi-Vendor platform provides a sleek, single storefront for vendors to make profiles and sell products.

Customers can place products from multiple vendors in their shopping carts, and you can have an unlimited number of vendor accounts.

Not to mention, the vendor admin area allows vendor-specific shipping methods, payout recording, and powerful product display tools.

Pricing

$1450 (lifetime)

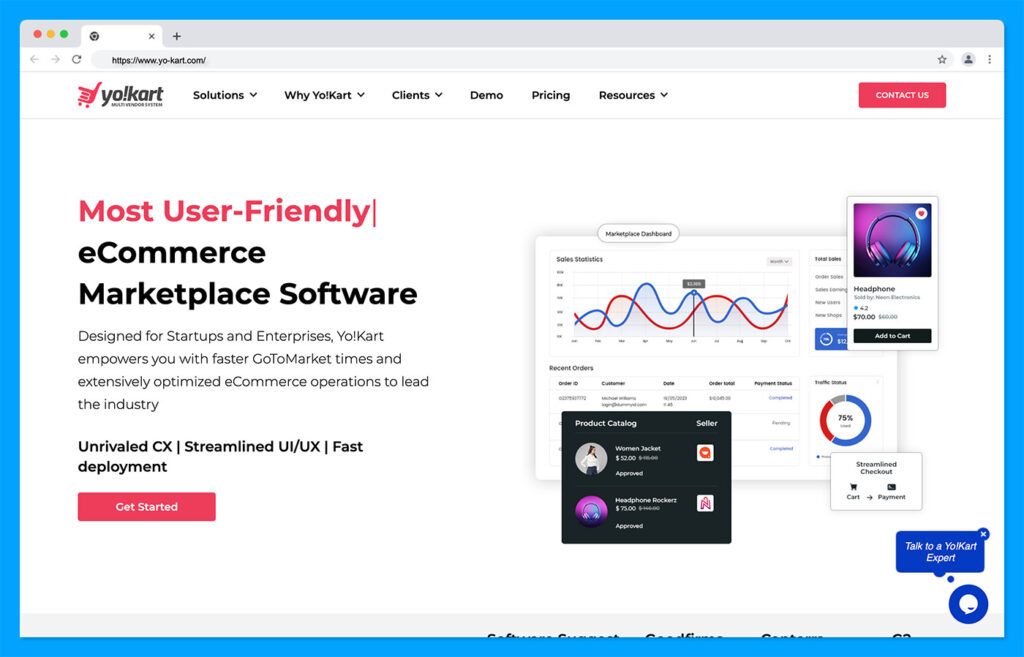

3. Yo!Kart

Yo!Kart is one of the leading eCommerce multi-vendor platforms to launch a B2C, B2B, or P2P marketplace.

It is a standalone platform where you don’t need to rely on third-party plugins or extensions to create a multi-vendor store.

With Yo!Kart multi-vendor platform, you can onboard unlimited vendors to your online marketplace. There are separate dashboards for the admin and seller to streamline marketplace operations. Also, there are individual vendor storefronts for sellers to personalize the shop as per their brand name.

The multivendor platform allows buyers to add/buy products from multiple vendors in the same cart. The marketplace owner can manage shipping at the order level or item level. Also, to automate Shipping, the platform has been pre-integrated with ShipStation API.

The ecommerce solution is highly flexible, scalable, and fully customizable to cater to individual business requirements. Yo!Kart has essential eCommerce features like product inventory management, real-time split payment, automated tax management, and more in-built.

The platform is pre-integrated with 20+ payment methods, robust CMS, native buyer apps, and popular third-party APIs. The multi-vendor platform is tested to handle over 1 million products and 250+ concurrent users successfully.

Overall, Yo!Kart is a great choice to create a successful online marketplace. You can contact their team and ask for a demo before taking the final decision.

Pricing

Its B2C version pricing starts at $999 (lifetime), whereas the B2B version costs $1999 (lifetime).

4. Sharetribe

Sharetribe is intriguing because the system is built solely to help people create marketplace (multi-vendor) websites.

They don’t mess around with standard ecommerce sites, so you can rest easy knowing they focus on this one area.

The initial starter package lets you have up to 300 members, and if you pay for the highest package you can manage up to 100,000 members.

What’s cool is that you don’t have to stick to the normal sales strategy. Rather, Sharetribe allows rentals, services and more.

The setup only takes a few minutes, and the global payments are good for accepting just about any credit card or online payment system like PayPal.

Users create listings and manage their own profiles, with features for including photos, pricing, location and product information.

The white label design is nice for attracting vendors, since they can upload their own logos, and the messaging and order management system is perfect for vendors to keep in contact with customers.

Pricing

$39 per month to $239 per month

Don't forget to check out our Sharetribe review.

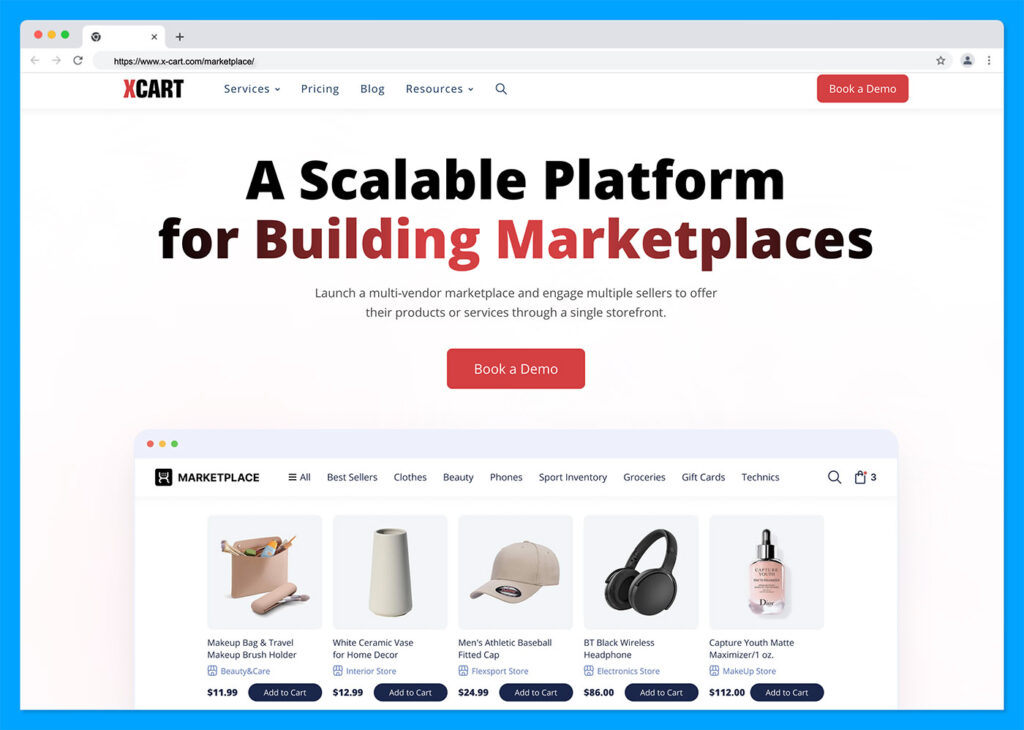

5. X-Cart Marketplace

X-cart delivers tools to small and large businesses that require an ecommerce platform. The package we’re focusing on today is called Multi-vendor, and it allows vendors to sell multiple products through your one storefront.

All customers are able to place products from multiple vendors in a single shopping cart, and the vendors can view orders, change shipping methods and assign products to different categories.

The website admin can set up shipping protocols, modify any product in the marketplace and register new vendors. the idea behind the admin interface is to give you full control over everything that goes on in your shop.

It’s a rather powerful platform, and I can see businesses of any size using this with success.

Pricing

$1495

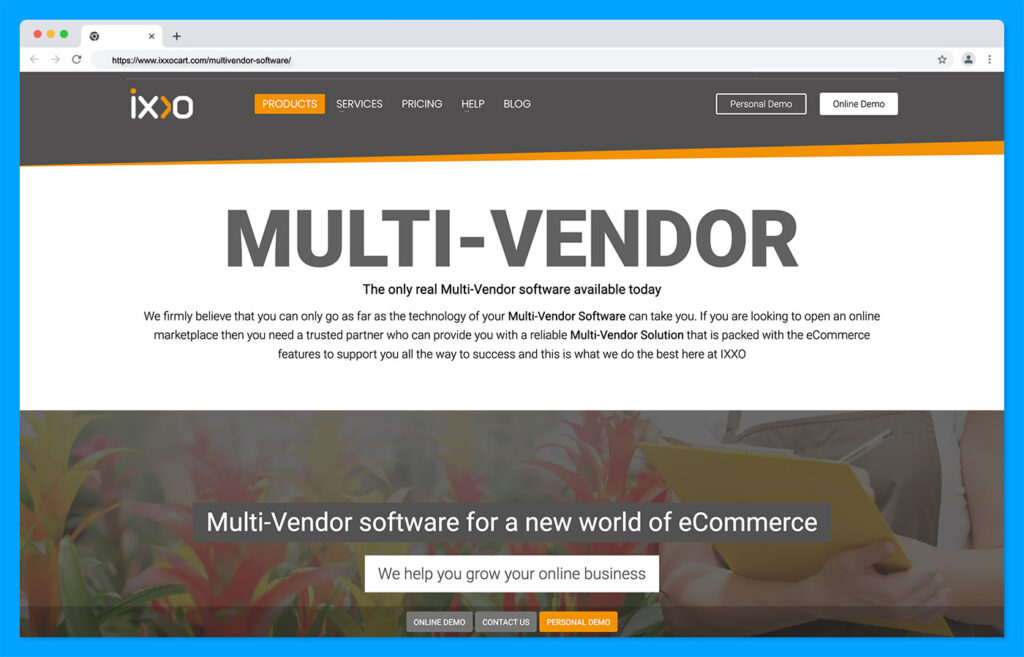

6. IXXO Cart Multi-vendor

The IXXO Multi-Vendor tool ranges drastically in price, depending on which features you want, but it’s important to know that this system works well on open source platforms like WordPress and Joomla.

The system seems fairly powerful, but I wouldn’t go as far as to say that it’s an out-of-the-box solution.

You have to host the multi-vendor site on your own servers, which is nice for ownership and security reasons, but it requires some tech knowledge.

The cool thing is that you can run the system as a standalone store or integrate it with something like WordPress.

Users can buy products from multiple vendors in a single order, and the vendors have tons of cool features such as choosing shipping methods, picking from product templates and creating tax rules based on product classes and location.

Pricing

From $295 to $1495

Any Questions?

If you have any questions about the best multi-vendor sites we just outlined above, drop a line in the comments section below.

Websites that find a solid niche, and allow artists and business people in that niche to reach customers, is the next big thing in online commerce. Share your stories if you’ve successfully implemented a multi-vendor shop.

Hi,

I’m looking to create a multi vendor marketplace where I create the inventory for my vendors with the possibility of them selling the same item. In my vision, under an item, the buyer can see what each vendor is selling the specified item for.

Which option would be best to complete this task?

Have you found a solution yet?

Thinking of a multi vendor platform for products. Heard sharetribe is generally good for testing MVP for startups. Anyone has any experience using sharetribe for products as a multi vendor platform?

Hi,

We are planning to start a multivendor platform for artists and we need a host that provides auction as a feature without requiring us to get a developer or offering the auction as a separate entity.

Anyone with an idea of one?

Do you have any examples of a contract between multi vendor website provider and the vendor?

Thanks for this.

I am looking to use the BUDDYBOSS marketplace. Any comment on this? It certainly looks to be comprehensive.

Regards

Bob

Hi,

Great article, I would request you to please help me to find a platform with good page load speed. I used wordpress+woocommerce but not really happy with it.

Hello,

Finding a good hosting provider should solve your current problem. Otherwise you may try switching to Shopify. You can read our full review here.

–

Bogdan – Editor at ecommerce-platforms.com

Hello, guys!

Thank you very much for mentioning CS-Cart Multi-Vendor in this articles! We greatly appreciate it. We’re glad that more people now know about the marketplace platform we’re making.

I’d like to notice that we no longer offer a 1-year Multi-Vendor license, a lifetime only. Could you please update the article? You can also add some examples of live marketplaces that work on Multi-Vendor. They are awesome: https://www.cs-cart.com/multi-vendor-success-stories.html.

Thanks again,

Yan from CS-Cart

Thanks Yan, I’ve updated the post!

Hey Yan,

we are working with CS-Cart Multi since 2 month. I think now, we have wasted the money and time of ourselves and our employees. It is not suitable for the EU and important functionalities are not included. We are extremely disappointed, as their support does not help either

I want to be able to charge buyers a commission, are there any multi-vendor platforms that do this already without having it to be developed?

Hello, all the multi-vendor platforms listed here will allow you to charge a commission for each sale.

–

Bogdan – Editor at ecommerce-platforms.com

i want to build a platform for vendors and service providers, where I:

(1) can get my commission from a specific markup of each vendor’s selling price.

(2) want to be able to track payment made directly to vendors so i can be paid specifically what they owe me.

(3)want the vendors to be able to add collection of items (e.g set of furniture)

(4) can include some tools on vendors admin panel (e.g invoice creation, shipping cost calculator. etc)

I dont know if CS-cart can handle all of these, kindly advice me.

Hello Kelvin,

With the help of a web developer you can implement all those features.

–

Bogdan – Editor at ecommerce-platforms.com

Nice post. Thank you for share. I have a ecommerce website for African print clothing online. Also planning to create new website using WordPress. I think it’s best to use because any non-technical person can do customization and small changes in website.

Good luck with that May! Cheers.

I want to create a marketplace for web designers to sell their own landing page templates and email templates for a specific software. Each supplier will have a page for each product which will have an example displayed as a LIVE Demo. The buyer can purchase the template as a digital download.

My main concern is, will the supplier be able to display their template as a LIVE DEMO on my website?

Can this be done without having the buyer stealing the code from inspecting the LIVE DEMOS?

Which of these can do this the best?

Ideally, I want to grow a website likeThemeForest, but I would start off with 10 – 20 templates. From there on I will recruit web developers to contribute as a supplier to my website.

We’re looking for a marketplace platform that allows customers to compare and eventually make a purchase by comparing an item across multiple vendors. Say they are looking for bananas, they search for it, and see Dole and Home Grown. They click Dole, and see the product page and somwhere that shows the prices from the different vendors. To be honest, something like Amazon for the local area.

Hello, I don’t think any one of the platforms offer out of the box the features you have mentioned above. You will most likely have to hire a developer to help you implement these features. Cheers!

Is their any multi vendor website that offers integration with various POS systems like square? This will update sellers inventory and pricing automatically.

Hello Tomas,

Shopify offers a POS system and they have also developed a multi-vendor app recently, called Multi Vendor Marketplace.

Cheers!

–

Bogdan – Editor at ecommerce-platforms.com

Fantastic article!

Quick question,

Do any of the described services allow you to create a kickstarter/gofund me style functionality where vendors can create countdown campaigns with different prices are unlocked?

Anyone used WCVendors for WordPress? I currently use on my site, and I think it’s great. However, it’s a bit cumbersome in terms of settings and customization.

Hi there,

A great article .. thanks. Can anyone tell me if these platforms handle vendor payments individually (from a multi-vendor order) or is it for the admin to ensure the vendor gets paid?

Thanks

It depends, you should be able to set a global commission for all the sellers or set separate commissions for individual sellers.

Hi. Not sure if this has been asked already, but would love an answer to two questions:

1. I would like to have built a C2C with B2C website built that allows individuals as well as businesses to add a single or multiple listings. I love CS Cart, but it seems to be only multi-vendor (unless I am wrong?), and Auctionsoftware.com (but do not know much about this company) . . . can anyone help here?

2. I would like to find a company who can either create one from scratch or incorporate a high-end piece of software into a very slick site.

Would appreciate your help.

P.S. Great article; really helped with my search

Hi John,

CS-Cart is not multi vendor only, you can build a traditional single-vendor store using CS-Cart.

Shopify is a also a great option (see our review here). You can find a list of setup experts, designers and developers here.

Great article! I have a question, what would you recommend someone purchase or start of with if they are trying to offer a multi-store e-commerce platform with one Admin console? For example, I would like the ability to provide my customers with the ability to have their own personal store/account to sell my product. I need to be able to provide them with a detail report that tracks their referrals so that I may give them a certain commission percentage from each referral.

Hi,

That was a good read, thanks. Can you help me in identifying best ecommerce platforms for a wholesale marketplace involving multiple vendors.

Which one of these do you think would best to still be able to customize how the website looks? As i did research on these places, It doesnt look like I am able to customize the templates they offer. I still want the website to be p2p , but I have a personal design for the website and layout. Im not amazing at coding but I do know how to code.

In this case I would go with WordPress and the Marketify Theme.

Best,

–

Bogdan – Editor at ecommerce-platforms.com

Thanks for the comprehensive overview. Do you know which platform comes ready for mobile? We want marketplace availability on Android and iPhone (in addition to web). If these platforms are not mobile ready, any tools which can convert them to be mobile ready?

Thanks.

Hi Mahmood,

Apps like Mobikul will let you create a mobile shop app with your existing CS-Cart store.

Cheers!

CS-Cart is fully mobile friendly. You can even edit the mobile version look and feel separately from desktop version. CS-Cart is a hidden gem that should be talked about more. The best one in this list in my opinion.

Thanks Catalin and Bogdan for being so helpful. One question I have is what is the best option for building an ecommerce marketplace solution that offers both services and products.

Hi Adel,

You can use WordPress with the Marketify theme and the EDD Bundle.

These two articles explain how:

How to Build a Digital Product Marketplace (Like Fiverr)

Cheers!

–

Bogdan – Editor at ecommerce-platforms.com

Hi to all,

Although many people haven’t heard about it, OpenCart, it is an excellent e-commerce platform. OpenCart also has integrations with Joomla .

Chris

Good read. This has save some time for us to do the comparison. Especially finding the right solution to use . Appreciate your effort.

I currently have my site build on pretashop- I am not Technology savvy at all. I am interested in expanding my site to become a marketplace. My current web builders are out of the country in philipines because it is more cost effective for me. My plan is to invite all stores from all over the world to sell on my platform, should I build my market place using pretashop? advise needed. DO you know of any successfully market place , build on pretashop? I don’t hear a lot about this company

Hi catalin,

I want to start my own online shopping site and i want multi-vendors from all over the world. Please help me how can i do it. It is an startup.

Hi Suvrath,

Maybe this article could help:

How to Build a Physical Product Marketplace (like Etsy) with WordPress and Marketify

Best,

—

Bogdan – Editor at ecommerce-platforms.com

Hi Catalin,

Very helpful! Have you come across anything that will allow the multi-vendor marketplace to function as an auction? And then separately, for items not auctioned, automatically discount prices as time goes by – like a real consignment store? Let’s say you are selling a painting. If it doesn’t sell within one week, the price automatically drops by 10%. How would you do that?

Thanks!

Hi Hilary,

We haven’t got the change to test anything like this on multi-vendor sites, but as far as I know there are plugins available for major ecommerce platforms like Shopify, WooCommerce etc. I’m pretty sure a developer could adapt modify a plugin like this to work on a multi-vendor website.

Cheers,

—

Bogdan – Editor at ecommerce-platforms.com

Hi Catalin,

Thanks for this article and valuable information. I have purchased the Agile marketplace module, and I am quite happy with the features. But one thing is worrying me : some of the code is encrypted, so how can I be sure about the security of the payment functionality. Thanks, Seb.

Hi

Thank yoy for this valueable information…

I am struggeling to find a solution for my b2b e-marketplace problem:

I have vendors that have different prices to different customers; and therefore i an trying to find a solution where the vendor can have the opportunity to assign different prices to their different customers ; so that each customer will see their customized price when they log in…

Just FYI; i am creating a marketplace but having the vendors invite their customers since it is a very competivie field and mainly driven by dropping prices.

Kindly if anyone has any solution to let me know as we are using Magento for developing the emarketplace.

Thank you

Faris

Hi Faris,

Yours is a very rare requirement, the only way to achieve it is through customization.

Prestashop has B2B capability, Magento too.

Nice article. Which would be the best multi-vendor platform for a start-up marketplace that chargers seller’s commission based on the categories of products sold?

Depending on the budget I will go with CS.Cart Multi-Vendor (more expensive) or Magento with Marketplace. Cheers!

A great article thank you. I hae been looking at Sharetribe but recently came across Apptha buy/sell ready script. Do you have any experience or feedback on this?

is it possible to switch from one frame work to another?

Hi Sam, you might need to hire an expert to help you with the migration between two multi-vendor platforms. I suggest contacting their support in advance.

How are taxes handled on these marketplace sites? The site withholds sales tax, and the vendor is responsible for filing yes? What if its second hand items and not brand new?

Hi Catalin

great article! i want to set up a BUY & Sell website for my business .. is there a platform here you can recommend that has no shopping cart ? i want both seller and buyer transact on their own convenience.

Hi, most of these plugins or theme price are cheap and good for beginners to start up. how secured are they? and also. no one knows how good their project might turn out. what happen if the concept really works and exploded into the next ebay or amazon. will these platform still support the massive traffic? are they scalable?

Hi,

Thanks for the good article. This is what I’ve been looking for. Do you know if any of those platform has a feature to identify and filter the geolocation of the vendors?

Thanks.

Hello,

Thanks for this post, that’s what I was looking for. I want to develop one of those platforms where you can sell digital content. The solution with Marketify and WordPress seems to be a good alternative, but I need to also have bookings. Does this solution integrate this ?

Thanks!

Hi, I have same question like KIM

I’m looking for a solution for making a multivendor website more like ebay, the solutions that i have come across are only really suitable for websites which only allow vendors to sell if they open up a shop on your store, i also want people to be able to sell items on my website as a one-off thing, without having to open up a store like ebay. Do you have any good suggestions for this?

Thank you! Wow, I was looking exactly for this. What a complete article! One question you may already know the answer to: Which of these services provide an affiliate program option for the users of the marketplace to help selling any product and earning a commision?

Thanks already!

Do you have a recommendation for a platform that also supports a blog system, a rating system, and a forum all on one login? I’m currently using WordPress and I love the platform but I can’t seem to find a suitable solution that will allow me to build a community within my e-commerce store.

Very helpful, many thanks.

I’m also in the process of implementing a marketplace.

About WordPress, most ecommerce experts argue it is a good choice only for small shops, because WP is is not a native ecommerce CMS. Nevertheless, in a marketplace we are expecting high volume of products and high traffic. Then, is still WordPress as good platform as the others?

I wonder, also, the way payment is usually performed in multi-vendor platforms. I mean, in a multiple vendor purchase: do all of the vendors involved immediately and directly receive the money? Or, conversely, the payment goes for the marketplace and then the marketplace distribute the money to the vendors?

Hi all,

Thanks Catalin for this very useful article, which helped us à lot.

I’m having à question about API accesses to those solutions? Indeed we want our marketplace to be available from mobile applications mainly.

So which one do you think has the most complete API ? (currently we are doing in-depth exploring of Cs cart Api which seems promising)

Thanks

Hi. Thank you for the great list.

Which solution besides sharetribe would you recommend for a multivendor marketplace for services (i.e tour guide), not products?

Thank you

Hi Catalin

We are currently building a marketplace for freshly roasted coffees and other artisanal products from different vendors, here in Europe.

We’re using Ignitewoo’s Vendor Stores plug in that works quite well so far. We have a custom-made WordPress site and the shop is integrated into it. It all looks really neat and is quite easy to use.

The main issue we have is with the shipping costs. We use a table rate shipping pro plug in that allows us to upload different shipping costs per vendor and country, but it does not calculate the shipping cost based on the weight of the order per vendor. This is a bit of a problem for us because sometimes a customer wants to buy more than one product from one vendor but in the current set up the customer will also have to pay the shipping cost for each item. This is obviously not an attractive feature.

Do you have any experience with this and can you recommend a way to fix this?

Thank you!

Hi Alex, I can’t help with any tips in this area but I hope a reader with more experience with shipping costs will read your comment and reply. Also this forum is a gold mine if you’re serious about ecommerce.

IXXO Cart is a scam. They do not deliver what they advertise and their whole company is out to take your money and scam you.

Mark,

Are you able to go into further detail regarding the issues you have had with IXXO. On it’s face, it looks to be the best option for starting an online multivendor marketplace.

I normally do not leave comments but after reading your post I felt that is an unfair statement. I am using IXXO Multi-vendor for more than year and all I can say is that the IXXO Cart platform is light years ahead it’s competitors and their support is always there when you need them.

IXXO Cart is definitely not a scam.

Hi, we have a magento ecommerce website. We are looking to add sellers from different locations who can directly delivery to their nearby customers. We want to put each seller for some specific cities, further we want the customer is able to see products which are from sellers of its city only. Does the magento multi vendor plugins have this option?

Hi Gagandeep,

I believe there is no out-of-the-box solution for this, however it is not so difficult to achieve it. Using free Geo-location APIs, you can detect and pass buyer location as a query parameter to fetch results specific to given location.

I am an entrepreneur currently working on my new business plan for setting up a marketplace in India. Its is going to require a lot of functionality and the major one is to enable the seller to sell their products by registering on my website.

I am currently confused about selecting the proper platform, that whether I should for CMS or customized one. Most IT-companies I am interacting with are suggesting Magento, and yes! I am allured by less investment comparing to customized one. But please give me your opinion for the same. As I will be spending a huge budget on Promotion and Marketing of my website, I don’t want my website to perform slow or have any problems when users proliferate.

I suggest to go with a development agency and discuss with them in detail all your needs and wants.

Have you looked at Makery at all? Can you tell me how this compares to Marketify?

Hi Catalin,

Very interesting article !

I have a question about this. Which solution would you recommend to develop a C2C (customer to customer) rental marketplace, putting aside Sharetribe ?

Hey, great article!

Have you seen this https://apps.shopify.com/multi-vendor-marketplace

Your thoughts on it please?

Hi Karan, yes I’m aware of it. Haven’t used it myself. Heard good things about it though!

Hi, im looking for a solution for making a multivendor website more like ebay, the solutions that i have come across are only really suitable for websites which only allow vendors to sell if they open up a shop on your store, i also want people to be able to sell items on my website as a one-off thing, without having to open up a store like ebay. Do you have any good suggestions for this?

Thank you for your informative article. Finding a platform for a multivendor site is a daunting task and you helped me narrow it down a bit. For my site, I’m looking at Magento, YOKart, WordPress with the Marketify theme or XCart. If any of these platforms do not allow a buyer to place items from multiple sellers in a single shopping cart this will be a deal breaker. I know that Yo!Kart and XCart have this feature. Can you tell me if Marketify and Magento have this feature as well?

Thank you,

Vay

Hi Vay, I’m pretty sure all of them have this feature but please get in touch with their support teams as well, just to double check…

Hi Catalin,

This has been a very useful read. I wanted to pick your brain on something. We have built a marketplace of fashion stores across the city. Till now, all tech has been in house where we have spent some 10-15 K USD. From a feature set perspective, these sites offer lots compared to what we have. What we have done is custom integration with local shippers, custom integration for india based payment gateways and a few location based features. We also have micro-sites for each of our individual stores where each micro site is made to look like a specialized site for each store. Do you think I can move to one of these multi-vendor platforms. I am burning cash becoz of tech and my aim is to minimize that.

Thanks

Hi Krishna, I feel your pain but not sure if you should move. You might need to ask a developer to see what will work better for you in the long run. Best of luck!

Hello – thanks so much for this great information! I’m wondering if you could point me in the right direction for a very specific purpose. I have a small coaching company and I would like to create packages for my clients with different types of items. Everything is working great except for being able to integrate the products that I own & create (videos, PDFs, coaching sessions, etc) with assessments that I have licenses from a 3rd party. I pay to have these assessments in a branded shopping cart through the parent company – the orders go through their ejunkie cart and customers get emails from them (as if it were me.) My problem comes when I want to include one of these assessments with the other items like coaching or a video. Would I be able to create a package that combined my videos, coaching sessions, PDFs etc with assessments from that parent company cart if I were to go with a multi-vendor e-commerce marketplace? We are small but would like to scale up…at this point though it is basically my cart (my items) with my branded cart (belonging to parent assessment company.) What solution could you recommend that would fit those needs and let me sell their assessments and my items as one package? Any advice or direction would be greatly welcomed.

All the best,

Megan

Hi Catalin,

Thanks for the very helpfull article!

I was hoping you could give me some advice; I want to create a marketplace where I myself, the admin, puts all the products online but does not sell anything. Then the other vendors can search for the product in the catalog and only have to put in the price for which they want to sell it.

Afterwards a customer who visits my marketplace can click on a product he wants to buy, and then select a vendor from the list of vendors that sell that product.

Could you tell me what product/software I could use best for this?

Thanks in advance!

hi Catalin, I’m creating a website very similar to esty, a multi-vendor system by using the WordPress platform, paired with the Marketify Theme but i don’t know what plugin(s) I need to allow vendors to sell clothes, jewelry, book, accessories, ects. Do you know any i could use?

Hi Shelton, thanks for stopping by. I think this post my help: How to Build a Physical Product Marketplace (like Etsy) with WordPress and Marketify

Thanks for sharing the article. We are a software vendor and we are looking for a marketplace platform for our tenants to browse and purchase additional functionality which is then accessible to them in the system. In this manner a very price competitive base offering can be made available with the option to purchase the additional modules that are desired. It is also intended that third party developers can write to our standards and submit new functionality for the system. Would you mind to share your experience?

Catalin, great post — it made my day. I am looking at replatforming my website, Citasca.com, off of Sharetribe. I am looking for a solution that makes delivery of content (basically a few lines of text, preferably where the formatting — ital, underscore, etc. — is preserved) easier. Sharetribe was built with traditional marketplace products and services in mind (vs. providing info/content). It requires a bit of interaction between buyer and seller to close out transactions. Citasca.com is basically a marketplace for selling a citation for a point of law. At point of purchase, I’d like to provide for auto delivery of the citation (or auto access to the citation for the buyer). Any recommendations?

Hi Catalin! Could you comment on the Multi-vendor marketplace tool for shopify? Here’s the link: https://apps.shopify.com/multi-vendor-marketplace?page=2

Hi Mel, haven’t tried that yet so can’t give any comments. Thanks!

Mel – have you used the Multi-Vendor app for Shopify? We are just trying it out now and it doesn’t seem to have great documentation. Any chance we are just overlooking something and it is easier to configure than it appears?

Very nice article,thank you for that.

I would like to know which platform is the most customizable.

I would like to be able to customize the way products are displayed in two ways :

-selection : I have a Business logic on which products I want to display and why.

-design: I have a reason why I want to display the products different from the traditional grid view.

Last element of customization, I want to be able to be notified via email when certain conditions are met such as when user x orders 3 different products from 3 different vendors.

Do NOT waste your time with Prestashop +Agile Marketplace extensions. Not only is the software incomplete but it has A MILLION BUGS. Kinro Sho speaks no English, refuses to speak on the telephone and writes back responses to questions and concerns in ways that are impossible to understand. I wasted a year on this. DON’T do it to yourself. What a rip off and a complete joke.

thanks for a great article.

I m after a multi vendor site with auctions.

I have tried Magento, which I think is a bit heavy and the graphic interface is old and slow. Found modules that can handle auctions and multi vendor, but it seems costly.

I have also tried Opencart and found a free multi vendor module but it cannot have auctions.

The core of the business is selling services so there is no need for a lot of shipping etc.

but it must be possible to make additional bespoke changes to the process and find people who can do it easily

Dear all,

Many thanks for this article.

In my case I am looking for a multivendor site – but with access to the code to be able to customize it …. do you have any idea ?

Many thanks.

Hi Chancel, how about the WordPress route?

Catalin

Great article. Thanks. Have a client who wants to build a marketplace for different jewelry products. He wants different vendors to be able to describe themselves in a unique fashion(single mom with 9 kids.. buy my stuff). He’s not computer savvy so wants everything automatic. If he gets a 10% commission, buyer pays 100 and he automatically gets 10 in his account.. pretty typical..

I like what Sharetribe offers but they are in Finland.. Support issues??

I am also WP savvy. THe Marketify EDD option seems good but it’s for digital only??

Any suggestions??

Thanks

Dave

Hi David, Marketify works for physical products as well, but I assume it’s less scalable than Sharetribe. Maybe contact their support in Finland and see what you make of it?

Hi all,

for all those who are looking to build a marketplace with vendors similar to etsy, Alibaba, Amazon etc. I strongly recommend IXXO Multi-Vendor. To my opinion is the only real multi-vendor platform available today and is miles ahead it’s competitors.

Hi, I need some advice choosing an ecommerce platform that will scale with my company. currently i am on WordPress using the Dokan plugin, although I am not happy with the plugin. I’m not sure if I should invest into fixing the plugin and building upon it, or if I should move to Shopify using thier Boldcommerce plugin. so my question which platform is better for scaling an ecommerce platform, wordpress or shopify?

Hi Kelechi, both routes can be a good fit but it always depends on your personal needs and knowledge. If you’re not keen on learning coding or hiring a developer, I would strongly suggest to go with Shopify.

Hi, I ran into dokan and bought it and it has been a nightmare, looking for alternatives and saw this post. Thank you so much.

Hi Catalin,

Thanks for the article. Which interface do you think is best for the suppliers to load their product images etc. ? I guess wordpress is a bit fightening for them? What do you advise?

Hi Frank, depends on your (team’s) development skills. I think Magento might be more flexible, but I would give a try to each of the platforms from this shortlist to see which one you’re more comfortable with. Cheers

Most useful and considered, thanks for sharing your research!

What is the best option for a marketplace website for someone who is not very technical? The shop needs to allow sellers/vendors to list and sell products (kind of like etsy) and I would take a percentage of any sales.

Hi Jill

Adding / updating features in the website on an on-going basis is an essential part of multi vendor ecommerce business, you can not run the business without having a technical guy or a team at your disposal.

Hello,

Thanks for the informative article. I was looking to implement a multi-vendor shop using Joomla Virtuemart (I very familiar with this) and Joomla Virtuemart Multi Vendor Marketplace extension or with Opencart (Haven’t used this before) and Multi Vendor/Drop Shipper module.

What is your take on this?

Hi Munyiva, didn’t try that option but I’ve created this guide in case it helps: How to Build a Physical Product Marketplace (like Etsy) with WordPress and Marketify

Great job Catlin. I am also on the same boat as Octavio and Michelle, looking for the perfect service marketplace. Any help?

Hi Moni, how about this guide?

Hello, I have a question similar to Octavio. I would like to build a marketplace where vendors can sell services (homemade meals). Important features would be a filter for the city, rating function and preferablly direct payment to the seller. Which platform would you recommend?

Maybe this will help?

Hi, which one you recommend to sell services?

I mean for example, in a coaching market place, which program /plugin allow the coaches to sell their consultation using a agenda?

Octavio, I believe you could use a similar process with this one and do some tweaks? Let me know.

thank you very much, Do you know where can I find themes for magento marketplaces?

I would start with a search on ThemeForest.

Many thanks Catalin, of course I know about Themeforest, but in this templates there is no themes where in the top you can choose BUY or SELL or maybe open a store. I want to make a markeplace with this modules and I would like to have a theme in this sence. Thank you very much!

Thanks Catalin for adding FATshoppe into the best eCommerce platforms list, but we wish to rectify few facts mentioned by you as FATshoppe focuses majorly on small business aspirants and offers them powerful storefront within their budget. New businesses can grab it at small price of $250 and start their own online store without any hassle.

Please update the price i.e. $250 for ready-to-start multivendor website (not $4999).

Hi there, thanks for the headsup, done!